How to make a budget for 2022 — essential tips for saving money

How to make a budget for 2021 — essential tips for saving money

The new year marks an ideal time to build and review your budget — a record of how much money you bring in and where you spend it. Most people have a firm sense of how much coin they earn, based on their salary and paycheck from a full-time employer or from a blueprint of self-employment. Notwithstanding, tracking where your money goes is trickier.

Many adults avert a cold-difficult-light-of-24-hour interval reckoning with what they're spending because it'south hard to un-see what a upkeep reveals. Most budget reviews show where you waste material money, ways your lifestyle exceeds your earnings, and means you could reduce or sacrifice some expenses to better live within your ways or save more than.

- The best budgeting apps to effort at present

- Third stimulus cheque: Get the latest updates

Budgeting isn't meant to shame you. Instead, making a budget empowers you to make informed decisions near your priorities. Perhaps y'all can live without a few of your favorite splurges each calendar month if that means y'all can fund a great holiday. Perhaps negotiating with your mobile phone provider or refinancing a mortgage would save hundreds of dollars per calendar month that could go toward accelerating debt repayment or saving for a major purchase (computer, home repair). If you don't crunch the numbers, over time the numbers may crunch you.

Here's everything yous demand to know about making a budget.

How to make a budget: Where'south your money coming from?

To make a budget, y'all demand a clear sense of income and expense sources. Income sources include your bacon, the sum of your 1099 piece of work as a contractor, any income from hire (Airbnb, subletter), or income from other sources (child support, royalties, side hustles, etc.).

Almost people have a articulate sense of their income, just if information technology arrives sporadically or varies in amount, attempt tracking it over the form of a month using the Income and benefits tracker tool from the Consumer Finance Protection Bureau.

How to make a budget: Calculating your expenses

Expenses include your needs (food, clothing, shelter, transportation, phone), desires (leisure activities, dining out), debt repayment, charitable or gift giving, and saving for the time to come (large-ticket purchase savings, emergency savings, savings higher up and beyond an employer's 401k plan). If you want to go former-fashioned, review banking concern statements and credit cards online; if you tend to employ cash, invest in a notepad to track spending or save receipts. Some credit cards offer "end of yr" summaries of spending by category to assist customers assess their behavior. You can rail expenses using this worksheet from the Consumer Finance Protection Bureau or you can use this combination income and expense worksheet provided past The Federal Trade Committee.

If you lot have the time, tracking your budget for the entire prior year can be instructive and give a very clear flick of where your money goes. At the very least, tracking your upkeep for 1 quarter (or iii-month period) will requite you a sense of where small, everyday expenses brainstorm to add upwardly — from pay parking and lunches out, to lattes or a collection of $five and $10 app subscriptions. Once you've begun to see patterns in your spending, you can make up one's mind if yous demand to change your behavior and, if so, where.

How to make a budget: Apps to manage your budget

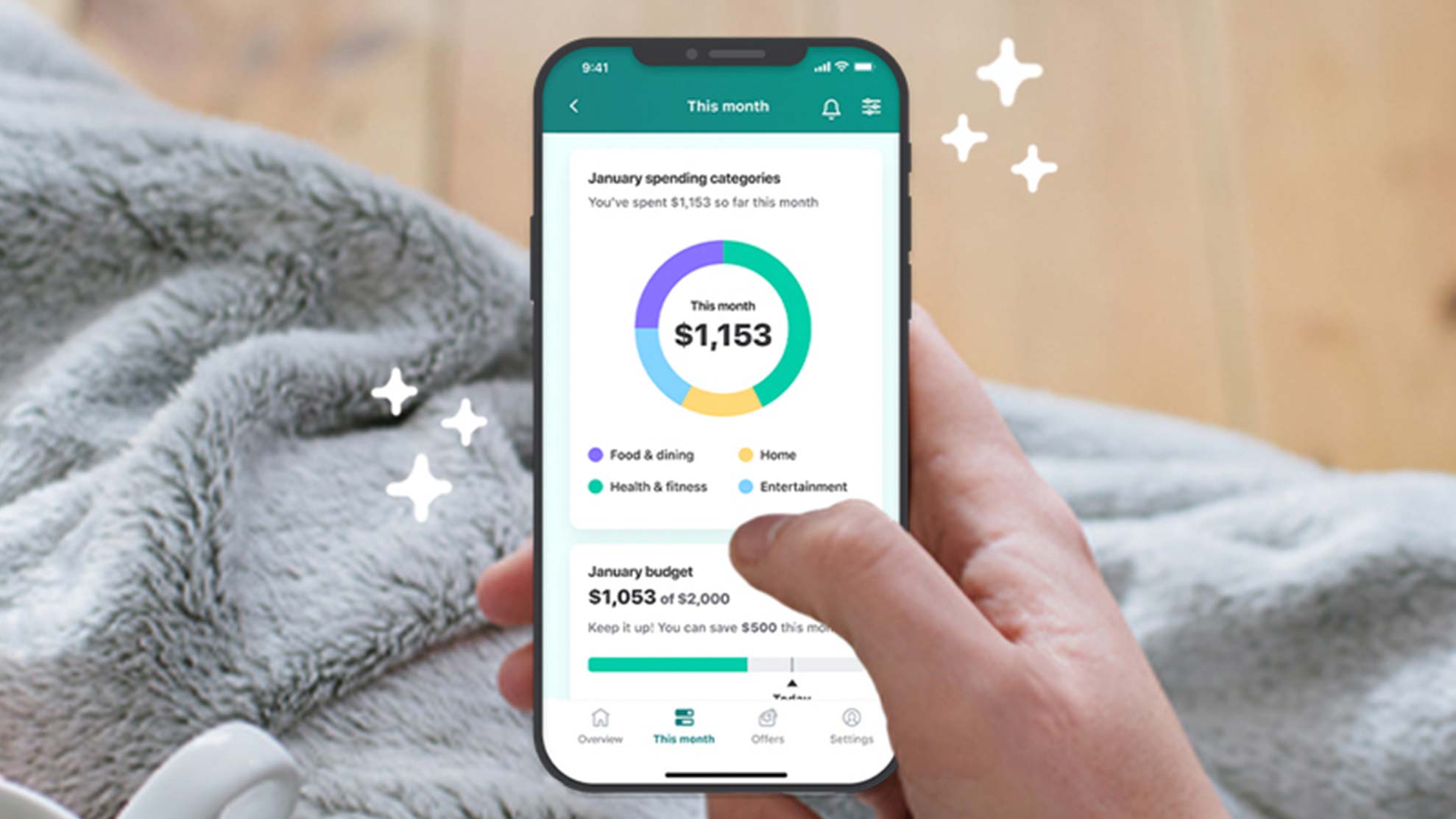

Desire to automate your budgeting? You're in luck. You can use apps such as Pocketguard, Mint, You Need a Budget, or NerdWallet to monitor spending and cash flow. (Your cash flow is positive if you had money left at the end of the month, negative if yous spent more you brought in.) These apps piece of work by syncing to your accounts and automatically analyzing spending activity.

Many of these apps send you alerts when you receive deposits, if your credit score changes, you lot max out a certain spending category, or if other metrics of your fiscal health shift. Powered by AI, these apps don't judge y'all -- they simply report the news, and they do so early and often so you tin can grade-correct spending habits that may run counter to your goals. Check out the best budgeting apps we've evaluated.

How to make a upkeep: What's a realistic corporeality to spend?

Your budget provides you with a comprehensive look at what you're doing with your money. Depending on your age, life stage, and geography, your budget makeup may look very dissimilar from someone else's. Still, it's helpful to gauge what financial experts recommend as reasonable percentages to spend on different expense categories, so that if you reallocate how y'all spend your money, you're realistic about your plans.

fifty-30-20 Method

Using the l-30-twenty method, this is what a budget might look like for a person bringing home $5,000 per month (after taxes and retirement are deducted):

Needs: fifty% ($2500)

• Housing ($1500)

• Groceries/drugstore items/cleaning supplies ($450)

• Utilities ($200)

• Transportation/gas ($175)

• Mobile telephone/Cyberspace ($125)

• Prescriptions ($l)

Wants: 30% ($1500)

• Dining out/social life ($400)

• Holiday savings ($200)

• Grooming/self-care ($200)

• Apparel ($150)

• Other/unexpected ($150), i.eastward. car repairs, home maintenance, medical

• Charitable giving ($100)

• Gifts ($100), i.e. saving for Christmas, birthday presents

• Parking spot ($75)

• Gym ($75)

• Hobbies ($25)

• Streaming media ($25)

Savings and debt: $1000

• Savings ($250)

• Pupil loans ($350)

• Car loans ($200)

• Credit bill of fare debt ($200)

Peradventure renting a room in a grouping house with friends in your 20s only consumed 15 percent of your income, merely one day you program to ain a home. Chances are, yous'll demand to upkeep much more than than 15 percentage of your income to pay for a mortgage. In other words, don't get stuck on a budget components from one life phase every bit you enter another.

Senator Elizabeth Warren is credited with popularizing the l-xxx-20 budgeting method, in which 50 pct of income is allocated to needs, 30 percent to wants, and 20 percent to a combination of savings and debt. Check the box beneath to run across how a person bringing home $v,000 per calendar month in after-tax income might manage a upkeep with this framework.

There are other budgeting methods, notwithstanding. For those merely starting out, an 80-20 budget, where 20 per centum of the budget goes to savings and the residual to necessities and wants, is a method that will force y'all to set aside twenty percent no matter what for savings and adjust expenditures to alive on the balance. In the example above, the same person would demand to trim $750 in expenses to set aside $1000 per month in savings, which would include emergency savings equally well equally other savings such as optional retirement accounts.

How to make a budget: Contrary budgeting

Reverse budgeting can be useful too, notes Goldman Sachs visitor Marcus. In this approach, rather than taking your income and paying expenses from it starting time, you lot focus on paying yourself outset (in the form of savings) and and so living within the rest of your means. This sort of approach can exist useful for a self-employed person or someone with variable income streams, so you empathize but how much you need to earn to "hit your numbers" and where the funds go first, setting aside for saving and then addressing other cadre expenses. If cash flow is positive, you tin can use the unlocked discretionary funds nonetheless you want.

Other factors tin can influence how you lot manage your budget. Lenders offer mortgage loans and many landlords ask for evidence that you spend no more than 30 percent of income on housing, significant that if you programme to seek a mortgage or charter information technology'due south good to line upwards these metrics, if you can, prior to applying for a loan or new rental. Of course, income size and local housing expenses can vary widely. (If you lot're earning $100,000 and spending more 30 percent on housing, you'll yet have higher disposable income left over than a professional paying $12,000 a year on hire from a $40,000 salary.)

How to make a budget: Put your upkeep to work

There are several mutual reasons people review their budgets: They know they spend more than they earn; they desire to acquire exactly where their money goes; or they're assessing how to adjust spending then they can relieve more, finance a goal, or increase emergency or retirement savings contributions.

If you're seeing negative greenbacks menstruation, double-check that you're actually factoring in every unmarried expense. It'due south easy to forget small transactions ($v coffee drinks, a $10 monthly fee for an app, $15 banking company fees), which can add together upwards over the course of the year, or perhaps yous're under-budgeting — planning to spend less on variable expenses (groceries, utilities, gas) than is realistic.

If you're tracking your upkeep manually, get over your information sources with a fine-tooth comb, and if you're using an app, well, auto intelligence doesn't lie. If yous're in the earlier, lower-earning years of your career and you're eligible for a raise or because switching jobs to get 1, or if you're able to earn funds from a side hustle or freelancing, your budget presents articulate testify of just how much you need to earn. If you're more experienced, your budget may bespeak where you lot've been splurging — you, too, can opt to earn more, just at some point you'll need to supersede an "earning more than" habit with a "saving more" addiction then your lifestyle doesn't outpace income.

If your greenbacks flow is positive but you're gob-smacked to learn how much you're spending on certain wants, consider ways to peel costs and where y'all'll re-assign funds you lot unlock. Nixing a $500 annual flying to your favorite hotspot and spending $150 to drive to a regional retreat instead saves $350 that could become toward savings. Reducing a monthly dining-out budget to $150 from $250 would unlock $100 per month or $1200 per year. That might exist enough to crash-land up savings for a goal like a down-payment on a abode or new car. If yous're hit with seasonal costs — higher winter heating bills, a spendy Christmas gifts tab, physical therapy during your soccer season — tally what those expenses expect like and plan to set aside a little each calendar month for them.

Once you actually understand where your coin goes, you lot can optimize the way you spend it. Those on any upkeep may wish to periodically review ways to lower routine expenses. Sometimes y'all can save money with no compromise in service by but calling your Internet or mobile telephone service provider and request almost new plans. Consider, too, means to save on groceries — joining a warehouse club or doing more from-scratch cooking will dramatically lower a monthly food tab. Mortgage and student loan refinancing are other infrequent simply impactful maneuvers that can help you lower payments on debt, often by several hundred dollars per month. But optimizing won't assistance much if you don't outset make the attempt to understand what you normally spend.

Source: https://www.tomsguide.com/how-to/make-a-budget

Posted by: dykebutiedis.blogspot.com

0 Response to "How to make a budget for 2022 — essential tips for saving money"

Post a Comment